Business enablement

Human capital

Overview

Throughout the year, our primary emphasis on human capital revolved around executing, overseeing, and assessing the effectiveness of our People and Culture Strategy. This strategy is intricately aligned with our Recover and Sustain Strategy. Our aim is to construct an organisation renowned for its adaptability and exceptional performance. This entails bolstering our talent pool, prioritising the development of future skills, positioning ACSA as an employer of choice, and fostering a transformationoriented mindset.

We also continue to monitor compliance with our Performance Management Policy to embed a culture of high performance and productivity, and have undertaken several research and special projects to ensure that our human capital management is informed by sound principles and best practice.

With these in mind, we continue to proactively manage the impact of the COVID-19 pandemic on our employees, whatever form that might take. In particular, all of our policies related to the ongoing threat of the COVID-19 pandemic or similar are aligned to national strategies and to the Occupational Health and Safety Act (No. 85 of 1993).

Hybrid Membership Programme

The most notable of the special projects we undertook during the year was the implementation of the Hybrid Membership Programme as the ‘new normal’.

After the first severe lockdowns of the COVID-19 pandemic, we introduced a hybrid working model wherever possible which, while successful, had some unintended consequences for our employees. Among other things, we identified that they felt a sense of alienation from the workplace and their colleagues, and also that there was an erosion of organisational culture taking place.

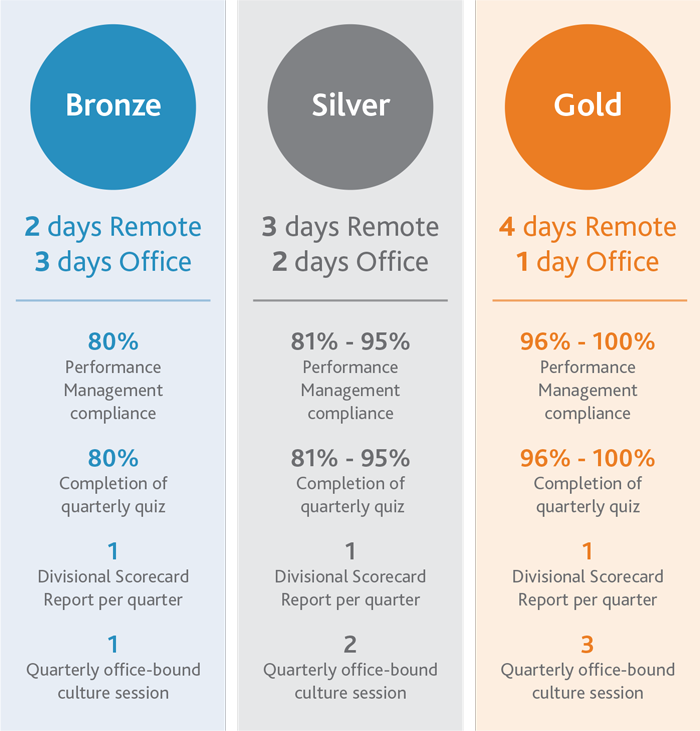

In response, we developed and launched the Hybrid Membership Programme for employees working on a hybrid basis, which is intended to rekindle a sense of engagement with the company culture, the office environment, and colleagues. Employees can attain various levels in the three-tiered programme by achieving performance, management, culture, wellness, and learning targets. This innovative approach is also aimed at driving and encouraging behaviours in line with our PRIDE values. The programme was officially launched on 1 April and the qualifying criteria are illustrated in the diagram below.

Project Sebenza

Another notable special project introduced during the reporting period was Project Sebenza.

To contextualise this, it is important to note that, due to the impact of the COVID-19 pandemic, we

implemented a phased

Voluntary Separation Package and Early Retirement Programme in FY2020/21 and FY2022/23. While these

interventions

were effective in achieving the cost reduction targets that were necessary at the time, the uptake of

the opportunities they

presented did, however, result in a major loss of critical aviation-related skills and resources. In

FY2022/23, as recovery from

the

COVID-19 pandemic became more sustained, we therefore had to lift the recruitment moratorium that

had been put

into place in March 2020 in order to rebuild capacity in line with traffic recovery.

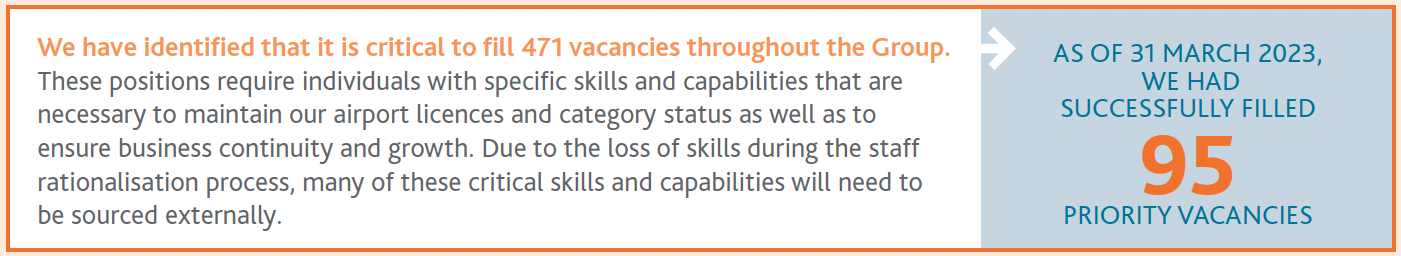

To expedite the process of filling priority positions and to mitigate recruitment costs, we therefore developed and implemented a dedicated initiative called Project Sebenza (Recruitment). Under the auspices of this project, the various divisions have conducted a thorough analysis of their human capital needs in order to identify and prioritise positions for which urgent recruitment is required.

Engaging in the Open Talent Economy

During the fourth quarter of the reporting period, the concept of the Open Talent Economy was also raised in and discussed by the Executive Committee.

As the world of work evolves in the post-COVID-19 pandemic environment, novel business trends are emerging and are challenging us to look at new ways of sourcing talent and integrating that talent into the workforce. Driven by the changes that have come about as a result of technological development and greater workforce mobility, we are currently investigating new staffing models and talent sourcing platforms, such as social media, in order to tap into the Open Talent economy. The existing Recruitment Management Policy remains in place to ensure that we remain compliant in all talent sourcing processes.

Governance Framework and Operating Model

As we aim for full recovery from the impact of the COVID-19 pandemic, we continue to implement, monitor, and evaluate the effectiveness of the Governance Framework Operating Model introduced in FY2020/21 and continue to actively engage staff, management, and the executive in the implementation process. In particular, the IT and Finance divisions are engaging with the operating divisions to align cost centres with the revised organisational structure outlined in the model.

This process is currently being tested on our IT system and we are currently sourcing an organisational design and change management service provider to guide us through the implementation process. The provider will work closely with the Governance Framework Operating Model Transition Office to execute strategic transformational initiatives.

Employee relations

Our employee relations environment, which we manage actively, is currently stable. In November and December 2022, ACSA, the National Health Education and Allied Workers Union (NEHAWU) and the National Union of Metalworkers of South Africa (NUMSA) engaged in wage negotiations, resulting in Inside Bargaining Unit (IBU) employees receiving a 7% salary increase. The decision to give increases to Outside Bargaining Unit (OBU) employees with back pay and the payment of second trench to IBU employees has further strengthened relations with organised labour.

The employee relations team has also actively engaged with organised labour to establish both national and local forums to facilitate ongoing engagements.

Employment equity and transformation

Detailed information about our employment equity and transformation status is given in the Transformation section of this report.

Learning and development

In line with TETA requirements, we submitted our Workplace Skills Plan (WSP) for the financial year. During the development of this plan, line managers contributed input related to strategic objectives, departmental business plans, regulatory training, workforce optimisation and transformation.

While TETA mandates that 1% of the total wage bill should be allocated to skills development, the advent of the COVID-19 pandemic and its subsequent impact on cash flow resulted in the training budget for the period having to be curtailed, enabling us to cover only regulatory training and the cost of Aircraft Rescue and Fire Fighting learnerships.

Our learning and development initiatives are delivered through two channels, namely the Training Academy, which focuses on commercial development initiatives for external customers, and the Skills Development Programme, which focuses on our internal employee development.

The Training Academy, which is the only aviation security training centre in the Sub-Saharan region, is currently implementing a commercialisation strategy. Detailed information about this and our learning and skills development programme is given in the Transformation section of this report.

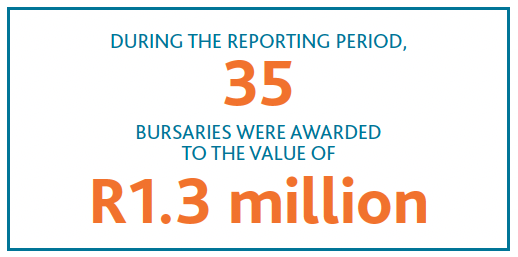

Bursary scheme

In addition to the learning and development initiatives we offer for our staff and external academy customers, ACSA offers the children of employees in Grades A to C bursary support to pursue studies in disciplines identified in the South African National Scarce Skills list. The programme also offers workplace exposure through vacation work, which provides students with practical work exposure and, ultimately, with permanent employment where opportunities exist.

Remuneration and performance management

The human resources cost-reduction programme resulted in a

freeze on salary increments for the years 2020 to 2021. In the

year under review, a decision was taken to pay a cost-of-living

bonus equal to a monthly salary to allow employees to recover

from the effects of this freeze in salaries over the years. We also

gave employees a much-needed market-related salary increase

in

March 2023, which was backdated to September 2022.

During the year, we therefore also reviewed additional benefits, such as our housing and transport schemes, and increases were granted on these. In addition, we are looking at restoring other benefits and allowances that have been frozen since 2020 in the next financial year. This will include allowing new entrants into the housing scheme and the payment of acting allowances.

Externally, we are benchmarking our salaries and aligning our remuneration policies with the market. In cases where we find we are below market, we will align our policy with market norms.

In all our activities, we adhere to the principles of good governance as set out in the King Report on Corporate Governance for South Africa™ (2016) (King IV). A full analysis of how we adhere to these principles is given in our Governance and Remuneration Report, which complements the Integrated Annual Report and forms part of our annual reporting suite. Full details of the mandates, activities and performance of the Committees of the Board are also provided in that report as are full details of our remuneration policies and practices.

Employee engagement and wellness

Despite budget constraints, we continued to actively engage with our employees and to support their wellbeing through various initiatives as part of our ACSA Cares Wellness Programme. In the 2022/23 financial year, the programme provided the following services to employees:

| Engagement sessions | FY22/23 |

|---|---|

| Financial Well-being Seminar | April 2022 |

| Nelson Mandela Day | July 2022 |

| Breast Cancer Awareness Seminar | October 2022 |

| Employee Value Proposition Interviews with Executive Team | September to October 2022 |

| Employee Referral Workshop | November 2022 |

| Executive Medicals | December 2022 – March 2023 |

Outlook

In the 2023/24 financial year, the Human Resources division will continue to deliver on the key priorities identified in the People and Culture Strategy and to monitor the implementation of the strategy.

A strategy review session was held in the fourth quarter of the reporting period and was used to set the tone for FY2023/24. Key deliverables and priorities were identified and work towards the delivery of these was undertaken in the first quarter of the new financial year.

Within the context of a more streamlined and agile operating structure, we remain committed to the wellbeing of our staff and other stakeholders, and we continue to actively engage with them in order to fulfil this commitment.

IT and digitalisation

Overview

Recognising the imperative to digitise the passenger experience, enhance the airport environment, and streamline our operational processes, we have pinpointed these as central strategic priorities for our organisation. In light of the COVID-19 pandemic’s profound impact, we have expedited this transformational journey.

Remote and hybrid working solutions had to be put into place at short notice and we had to rapidly improve our ability to deliver a contactless travel experience. Our operational processes also had to be extremely flexible in order to accommodate changes to lockdown levels.

Our IT Infrastructure and Digital Strategy has provided a robust foundation for the management of these challenges over the past three years. The key objective of this strategy is to adopt and leverage appropriate technology in order to enhance the customer experience and improve operational efficiencies while simultaneously protecting our systems and information. Our IT capabilities are intended to support our value creation process through the delivery of a consistently positive customer experience, paperless travel, automated cost management, greater efficiency, revenue diversification and, ultimately, business growth.

The digital roadmap put into place to support our strategy included an allocation for CAPEX of R1.2 billion for the five years to FY2024/25. Annual allocations have since been adjusted in alignment with the revised Financial Plan adopted in 2020. Of the R397.8 million budgeted for the reporting period, R367.4 million was used.

Despite having to work with a reduced budget, we have continued to honour all of our commitments on existing projects and to implement the projects for which tenders had already been signed prior to the COVID-19 pandemic. Other than these contractual obligations, we have prioritised urgent and high-impact projects intended to secure business security and continuity.

We have, in particular, had to prioritise cyber security as the incidence of cyber attacks worldwide has ramped up considerably since the start of the COVID-19 pandemic, partly due to the rapid implementation of remote and hybrid working solutions, which has resulted in system vulnerabilities across the board. In 2020 alone, malware attacks increased by 358% globally compared to 2019 and the incidence of cyber attacks increased by 125% in 2021. In the same year, nearly a billion emails were exposed to phishing attacks, affecting one in five users.

In 2022, Russia’s invasion of Ukraine had a massive impact on the cyber threat landscape. Since the start of the war, Russian-based phishing attacks against email addresses of European and US-based businesses have increased eightfold. Further, as supply chains become more interconnected and complex, 40% of cyber attacks on businesses now occur indirectly through the supply chain.

Our response

ACSA is a critical organ of state that connects South Africa with the international economy. We operate in an industry that has a major appetite for technology, not only for business purposes but also to secure the passengers and other stakeholders who use our airports. In order to fulfil our mandate, we have been leveraging technology and digitalising our operations, which has added extensive capability but has also expanded our threat landscape.

To ensure that Group operations are secure, compliant, and resilient, we have invested extensively in Microsoft security systems, both on-site and in the Cloud. Further investment in additional Microsoft technologies is enabling us to create an operating model customised to the needs of a state-owned company and to mature our overall IT capabilities.

Working in conjunction with Microsoft and South African partners, we have, for instance, established a dedicated cyber security operations centre (SOC) to deal with the threat of cyber attacks. The centre focuses on three key touchpoints, namely people, processes and technology and will receive considerable financial support from Microsoft over the next five years. SOC analysts are on duty 24/7/365 to focus on security incident monitoring and remediation, automation of core SOC processes, and the enablement of our technology investments.

Despite ongoing constraints on budget, we continue to use a zero-trust architecture approach by leveraging off existing investments and making use of a cyber security mesh architecture. This has enabled us to deploy security controls closer to our various assets and to support hybrid workers. While we have a high level of digital security, we continue to prioritise key initiatives throughout the business and to focus heavily on cyber and information security as technology develops.

Enhancing the passenger experience

Some notable projects will include:

- Facial biometrics-driven automated border control system, which was first deployed at Cape Town International in the previous period. Similar projects will be implemented at O.R. Tambo International in Johannesburg and King Shaka International in Durban.

- A contactless check-in system, which makes use of biometric information such as fingerprints and facial recognition software to provide a seamless check-in experience.

- Improved AI-enabled security surveillance systems that use intelligent camera equipment and analytics to identify anomalies in human behaviour without human intervention, thereby improving security at our airports.

- A drone-based airport and runway monitoring system, which is currently in the proof-of-concept stage. This will vastly improve our ability to monitor runway conditions and security.

- Extensive enhancements to the parking management system which, among other benefits, will offer passengers and other airport users the option of paying for their parking digitally, by-passing the need to use manual pay stations.

- The ACSA app, which is a downloadable mobile platform that allows passengers and other airport users to check flight information, access changes to the status of flights in real time, subscribe to receive notifications of changes to the status of flights, reserve and pay for parking, explore the facilities at all of our airports and browse the ACSA shop. Enhancements to the app are ongoing and, at present, we are working on introducing e-commerce capabilities. Based on passenger engagement and satisfaction surveys, we are also working towards introducing a feature that will enable passengers to track their luggage within our airports.

- A new eduroam solution was deployed in consultation and partnership with Wits University. This provides free-to-access off-site internet roaming for users in education and research and is currently used by 21 institutions of higher learning throughout the country. Users are authenticated with credentials from their home institution regardless.

- A new public address system, which has been deployed at seven airports. This has improved operational efficiency and provides the ability to make announcements according to regulatory requirements.

- An upgraded enterprise resource planning and queue management system, which has been fully operationalised to improve efficiency. This has introduced the capacity to track queuing hotspots and to monitor passenger security while queues are being processed.

In the medium-term, our priority will be to continue upweighting digital self-service programmes and to automate border control by integrating our systems with those of Department of Home Affairs. We will, in particular, be focusing on security processing systems that use facial recognition capabilities or other biometric information embedded in a bar code in each passenger’s passport.

We will also continue to strengthen digital integration across all of our operations in order to improve efficiency and enhance the airport experience for all stakeholders, especially passengers. We will, for instance, be working on backwards integration of the passenger interface, opening up opportunities to interact with passengers and other airport users prior to their arrival at the airport. Using predictive analytics, ACSA is well positioned to offer passengers a range of services such as airline, hotel and car hire packages that are best suited to meet their needs.

Organisational development

At organisational level, we are currently automating all human resources processes, which will vastly improve efficiencies. The new system will provide a range of productivity management tools, which will facilitate the efficient and effective allocation of resources as well as productivity monitoring. This project will be complete and fully operational by the end of the 2023 calendar year.

We are also working on improving the management of parking at all of our airports, which will not only introduce app-based features for airport users, but significantly improve business analytics and management reporting related to parking.

Another major project in progress is the development of a new enterprise performance management system (EPM) for all finance functions, which will significantly improve the time needed to finalise statements.

In addition, we are working on improving telecoms capabilities in our airports. We have, for instance, submitted a White Paper to ICASA with the goal of being able to implement one shared communications infrastructure throughout or airports. This will not only improve connectivity but deliver many economies of scale. We are also working on upgrading from Wi-Fi 3, which is currently in use at our airports, to Wi-Fi 6 or high-efficiency Wi-Fi. The latest iteration of Wi-Fi technology, this is designed to improve bandwidth, decrease network latency, and boost the battery life of wireless devices. Wi-Fi 6, which uses a range of new technologies, is faster, more secure, and more convenient than its predecessors.

Staff enablement

Most of our employees had the necessary systems at their disposal to work from home when the first lockdown of the pandemic was announced in March 2020. As soon as that initial ‘hard’ lockdown had been lifted, we had already rolled out Microsoft 365 across all our operations and introduced Adobe’s digital signature to complement existing systems and enhance security.

During the reporting period, we continued to focus on training and support for staff who travel frequently or work on a hybrid basis. Using a dedicated service portal, employees can request IT equipment and services, stay informed with regard to the status of their logged tickets, and engage with the service desk.

We further undertook an extensive programme to improve security on staff devices and also to improve usage of and comfort with such platforms as Microsoft Teams and OneDrive.

All of our activities are implemented within the framework of our Cyber and Information Security Strategy and are operationalised in the form of our structured and formalised Information Security Management System. Cyber and information security awareness sessions have been conducted at all our airports and we did not record any significant cyber security incidents during the reporting period.

Outlook

Information technology, similar to every facet of our business, has undergone the impact of essential cost-containment measures throughout the last three reporting periods. It is only at this juncture that we find ourselves in a position to commence with reevaluation of the key IT capital expenditure projects that were in the planning stage before the onset of the COVID-19 pandemic.

We are therefore engaging with various stakeholders with the intention of executing innovative IT and digitalisation initiatives through collaboration. These engagements have the potential to result in collaborative public-private partnerships.

All current and planned initiatives support the objectives of ACSA’s Recover and Sustain Strategy and the Growth Strategy that follows on from that. They are, in particular, designed to enhance the passenger experience, improve vertical integration throughout the Group and increase the proportion of revenue derived from non-aeronautical services.