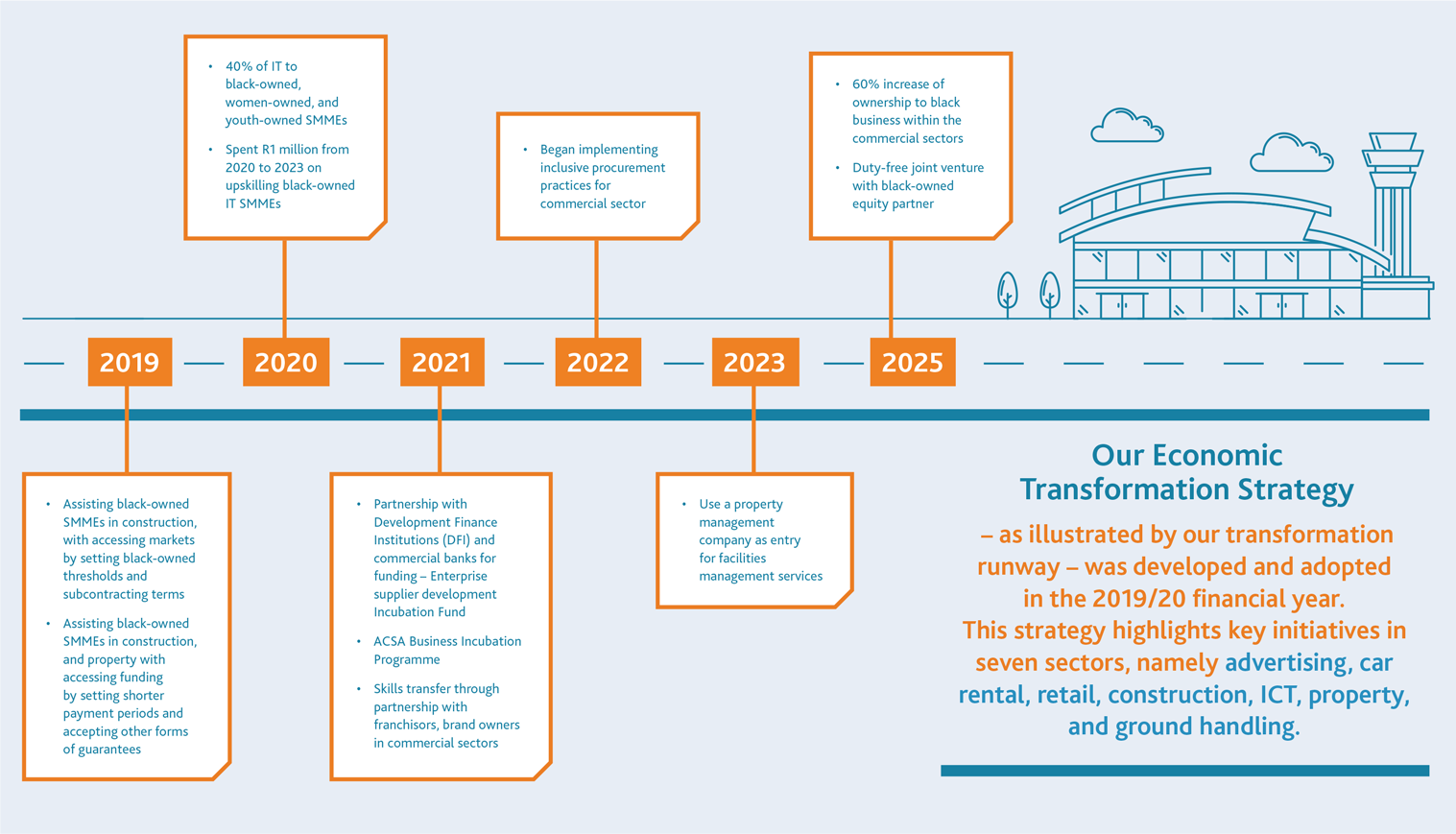

Transforming our supplier base

Seven key sectors

Our strategies in the seven key sectors we have identified are focused on preferential procurement and enterprise development. In the advertising, car rental and retail sectors, we engage in non-aeronautical revenue-generating commercial activities and contribute to the transformation of suppliers and service providers through various enterprise development initiatives.

In the ground handling sector, we do not engage in any commercial activities but contribute to transformation by setting specific transformation requirements in our ground-handling license agreements and by providing access to enterprise development opportunities.

In the construction, ICT, and property sectors, we support transformation in our supplier base through the preferential procurement of goods and services, setting procurement performance targets that are monitored and reported on using a transformation barometer dashboard.

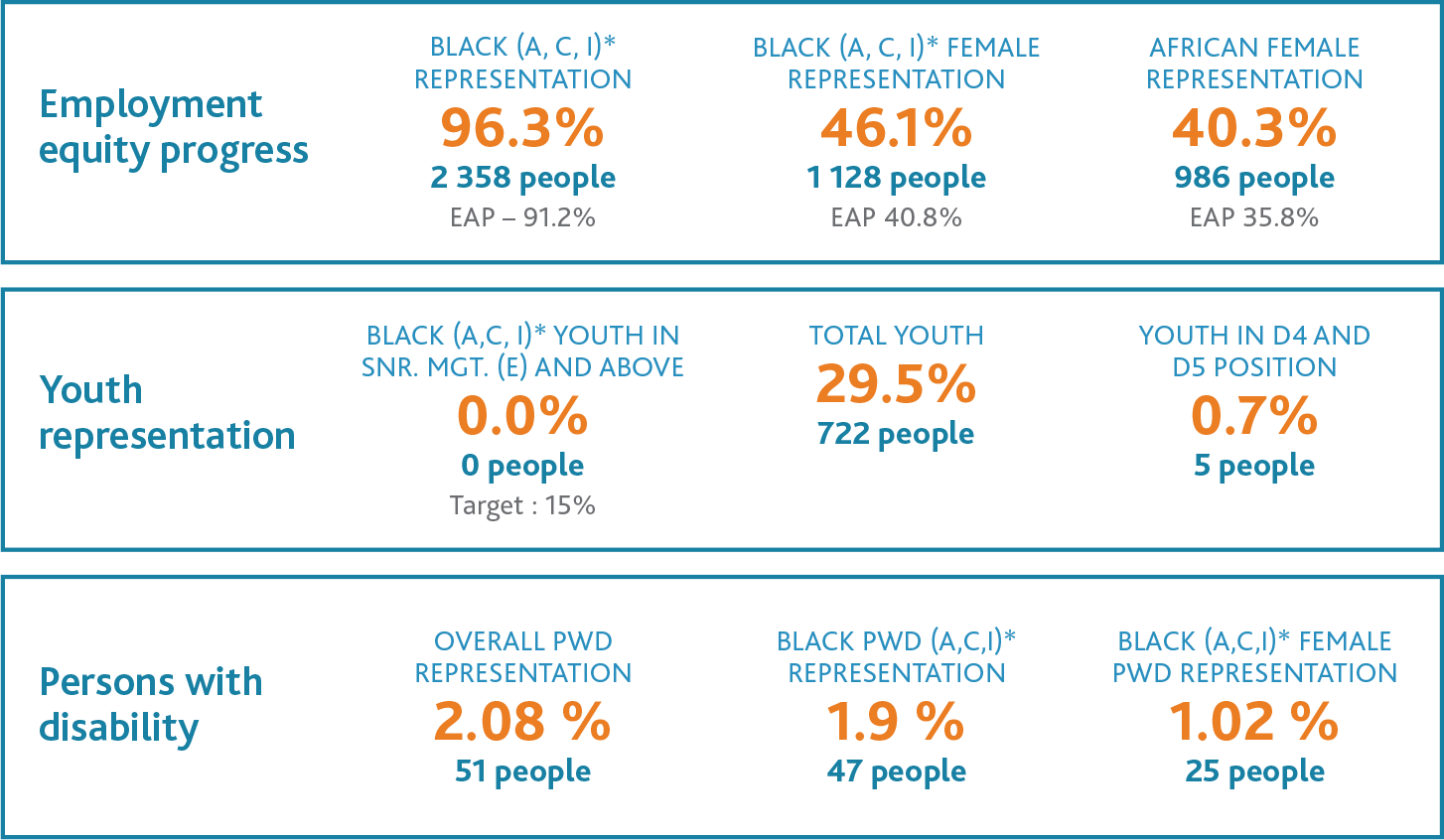

Transformation dashboard (as at March 2023)

Preferential procurement

At the start of the COVID-19 pandemic, we identified our top 100 suppliers and actively engaged with them about the impact the COVID-19 pandemic was having on our business and theirs. We also conducted a B-BBEE analysis of our top 20 suppliers and identified that there was a risk that their B-BBEE ratings could be downgraded due to the measures they had to take in response to the various levels of lockdown.

As part of our ongoing supplier performance monitoring process, we have actively engaged with all of these suppliers throughout the intervening period to ensure that they have been able to remain B-BBEE compliant. We have done this by using the transformation dashboard to monitor actual procurement spend against targets.

Construction

In line with this programme, all capacity projects, such as terminal expansions and the construction of additional aircraft stands, runways and lounges were put on hold during the COVID-19 pandemic, with the Group having to negotiate the cancellation of some 180 project contracts.

While we have now attained a secure recovery position, new passenger forecasts for FY2023/24 indicate growth of below that forecast prior to the pandemic. We are therefore adopting a conservative approach to reinstating capacity projects and those that have been approved for reinstatement will go into the planning phase before proceeding to the procurement stage. Depending on the size and complexity of the project, the planning and procurement phases usually take between six and twelve months.

As at the time of writing, we have Board permission to restart terminal expansion and modification projects at Cape Town International Airport, Chief Dawid Stuurman International Airport in Gqeberha (previously Port Elizabeth) and King Phalo Airport in East London. We have also received permission to reinitiate the refurbishment of the cargo precinct at O.R. Tambo International Airport and the refurbishment of the runways at Bram Fischer International Airport in Bloemfontein as well as at Kimberley Airport.

The most significant of these was the construction of the new head office complex at O.R. Tambo International, which was completed in FY2020/21. The complex consists of three buildings, all of which comply with the highest standards set by the South African Green Building Council. The Council is part of a global network of building councils that is leading the transformation of the built environment in order to make it more sustainable and environment-friendly.

Planning on another flagship project, a new mid-field cargo terminal at O.R. Tambo, has also resumed and the environmental assessment phase is currently in progress. This R5.7 billion project will contribute to socio-economic transformation in many ways, not least through job creation and the promotion of trade.

On an on-going basis, we engage with our industry partners to enhance their understanding of our transformation journey and of how this can contribute to the success and sustainability of both our business and their businesses.

During the reporting period, our overall performance in the construction sector met target, with 80% of controllable procurement spend (R701 million) going to B-BBEE suppliers. Of this, 82% (R576 million) went to 51% black-owned suppliers, against a target of 50%, and 56% (R390.7 million) went to 30% black women-owned suppliers, against a target of 15%.

Further, R109.4 million of controllable spend supported exempt micro enterprises (EMEs), representing 15.61% of total spend against a target of 20%; R370 million supported qualifying small enterprises (QSEs), representing 53% of spend against a target of 20%; R58 million supported youth-owned enterprises, representing 8.27% of spend against a target of 20%; and R17.3 million supported enterprises owned and run by people with disabilities, representing 2.48% of spend against a target of 10%.

Information technology

Current performance on all contracted projects is in line with our IT transformation targets. The process of digitalising outdated or redundant processes is ongoing and, during the reporting period, we issued a tender for the digitalisation of our immigration and emigration processes. Our journey towards delivering a contactless check-in experience is also ongoing and a pilot programme for O.R. Tambo International Airport is currently in the planning stage. Strategic projects like these will provide secure, innovative, and resilient digital platforms to meet customer expectations and deliver on our B-BBEE commitments.

The IT sector performance shows that 53% (R567 million) of the IT budget was spent with black-owned companies, of which 26% were owned by black women, 19.9% were owned by QSEs, and 37.05% were owned by black youth or suppliers with disabilities. Of the total spend on black businesses, R397.4 million was OPEX and R170.16 million was CAPEX. Audited expenditure and percentages will be available on completion of the audit by the Auditor-General.

Commercial

Our three flagship commercial sector projects, which were put on hold in 2020, were ultimately abandoned due to prevailing trading and financial conditions as these are not conducive to large-scale transformation projects.

Enterprise and supplier development

Our enterprise supplier development initiatives support not only large companies, but SMMEs as well. We include SMMEs in our supplier base and provide both financial and nonfinancial support to increase economic participation and stimulate job creation. This, in turn, supports the growth and sustainability of the aviation sector while also advancing our own transformation objectives.

With our support, SMMEs can grow into scalable businesses that have the potential to become part of our supplier development programme and, ultimately, to become preferred procurement partners.

During the course of the year, we undertook the following enterprise development initiatives:

The 2022 Entrepreneur Programme

Collaboration with the iLembe Chamber of Commerce, which supports enterprise development initiatives, continued during the reporting period. The Entrepreneur Programme is a business accelerator that aims to uncover the entrepreneurial potential in the iLembe District in KwaZulu-Natal, assist in the development of entrepreneurial enterprises and support them in the process of becoming fully sustainable.

A total of 80 entrepreneurs entered the 2022 competition and 25 finalists were selected to participate in the programme. All of the finalists committed themselves to the rules by signing a participation agreement.

Of the initial 25 entrepreneurs selected, a total of 20 completed the programme. Each of the these received a certificate of completion from the University of KwaZulu-Natal Graduate School for Business and Leadership, as well as an iLembe Chamber of Commerce membership certificate. The winners received business support funding to the value of R75 000, as well as media prizes to the value of R75 000.

Katemo General Trading (Health Food Store)

Katemo Health Food Store is a 100% black-owned business operating at Chief Dawid Stuurman International Airport and is one of the food and beverage spatial portfolio beneficiaries. An enterprise development agreement for a grant to the value of R575 000 is in place to support this SMME with equipment and start-up stock. The business is also benefitting from discounted rental to the value of R578 682 for the first three years of operation.