Run airports

Overview

Running airports is our core business and is essential to our value creation process. As we recover from the impact of the COVID-19 pandemic, the subsequent impact of the war in Ukraine, and the low economic growth at home, this remains our primary focus as we work to secure our sustainability and create a viable platform for future growth.

Over the past three periods, we have reimagined the way in which we run our business and have reconfigured our operations to ensure that we are a more flexible, efficient, and adaptable organisation. Within this context, our most immediate task is to restore our operations to full functionality, to build passenger confidence, to diversify our revenue streams in response to the fundamental changes that have taken place in air transportation, and to begin laying the foundation for a new kind of airport network in a new kind of socio-economic environment.

Airports are not only transportation nodes, but have a very important role to play in the country’s recovery from the COVID-19 pandemic. We see our network within this broader context and as a means to facilitate economic integration at both local and national level.

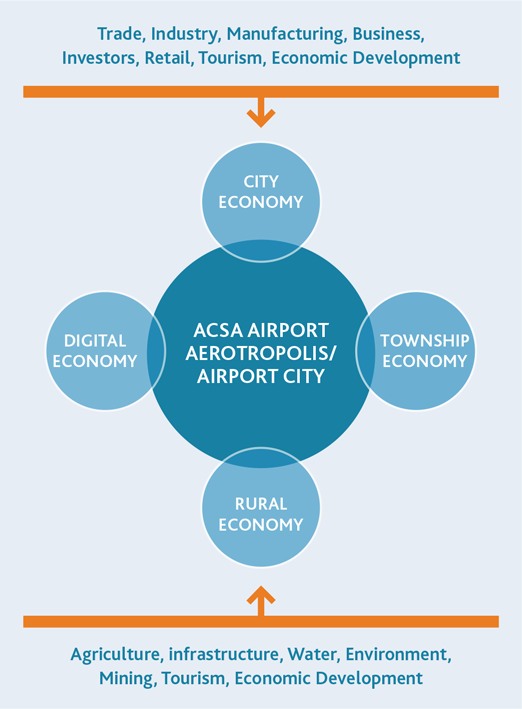

At local level, each of our airports is an engine for economic development in the region that surrounds the airport and an integrator of economic opportunities, as illustrated in the following graphic:

Local economic integration

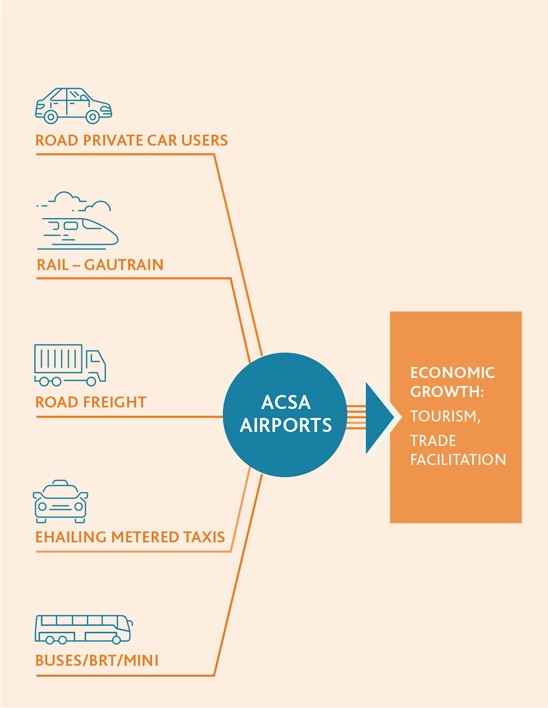

At national level, our network is a modal integrator that facilitates trade, tourism, and investment:

National modal integration

From this, it is clear to see that our network has an essential

role to play in supporting national efforts to recover from the

COVID-19 pandemic and other, more recent, external events

and to rebuild economic activity.

During the reporting period, we were nevertheless faced with the ongoing challenge of having to deal with uncertainties relating to the COVID-19 pandemic during the first half of the year and with its lingering impact on both aeronautical and non-aeronautical revenue throughout the year. We were also faced with having to deal with various external challenges such as the effects of the war in Ukraine and the severe flooding in KwaZulu-Natal.

The recovery in passenger traffic and aircraft movements therefore did not meet expectations for the year and was unpredictable in nature. By year-end, we had, however, reached a firm recovery position and are well placed to build on this in FY2023/24. This does, of course, need to be seen within the context of structural changes to the air travel and air cargo markets since the start of 2020.

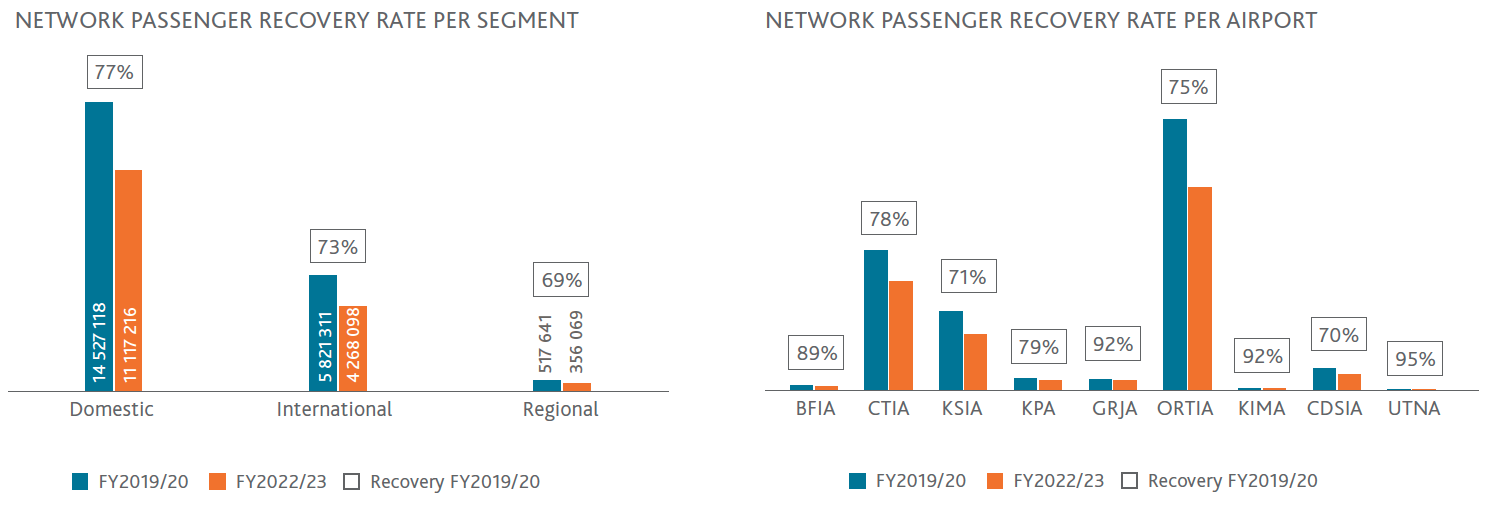

Business travel, for instance, continues to recover mainly in the MICE segment as both businesses and government have cut back on more general business travel. Recovery in both business and leisure travel also varies across the network, with Upington International being the fastest to recover, closing the year at 95% of its pre-pandemic traffic. George and Kimberly followed closely behind, having recovered 92% of their pre-pandemic throughput. The recovery at Upington and Kimberly was largely due to business travel, while George saw an increase in the number of leisure travellers.

In the international segment, Cape Town International has been the first airport in our network to recover to pre-pandemic passenger numbers. This was driven by a robust recovery in the number of international passengers flying directly into Cape Town, supported by the city’s highly active tourism marketing programme.

Sources of revenue

At ACSA, we have three sources of revenue:

Our core aeronautical revenue, which is derived from airport operations, includes regulated tariffs for aircraft landing and parking charges as well as regulated charges for passenger services. This revenue is dependent on scheduled airport traffic, which is measured in scheduled aircraft movements.

Non-aeronautical revenue from commercial income streams, such as advertising, retail, car parking, car rental, property leasing, hotel operations and airports management services.

Non-core revenue from the provision of technical advisory and consultancy services, both within South Africa and abroad, as well as revenue from our training academy.

| Core operations indicators |

|

|

|||||

|---|---|---|---|---|---|---|---|

| Annual departing passengerthroughput capacity | Total annual departing passengers |

Aircraft landings | |||||

| FY2022/23 | FY2021/22 | FY2020/21 | FY2022/23 | FY2021/22 | FY2020/21 | ||

| O.R. Tambo International Airport | 14 000 000 | 7 828 651 | 4 819 924 | 2 054 468 | 90 774 | 70 025 | 35 235 |

| Cape Town International Airport | 7 000 000 | 4 216 937 | 2 850 795 | 1 193 423 | 45 145 | 37 767 | 19 494 |

| King Shaka International Airport | 3 750 000 | 2 166 478 | 1 613 224 | 754 405 | 18 672 | 14 929 | 7 330 |

| Chief Dawid Stuurman (Gqeberha) International Airport | 1 000 000 | 597 570 | 455 748 | 212 074 | 20 001 | 20 001 | 15 016 |

| Bram Fischer International Airport | 300 000 | 160 120 | 327 227 | 161 589 | 6 868 | 6 236 | 5 293 |

| Upington International Airport | 50 000 | 24 671 | 306 732 | 134 160 | 2 825 | 2 127 | 1 348 |

| King Phalo (East London) Airport | 600 000 | 364 601 | 103 197 | 36 831 | 8 831 | 9 284 | 4 634 |

| George Airport | 450 000 | 384 060 | 47 222 | 18 041 | 14 349 | 10 213 | 9 143 |

| Kimberley Airport | 100 000 | 70 127 | 14 272 | 5 427 | 4 322 | 4 183 | 2 470 |

| Total | 27 250 000 | 15 813 215 | 10 538 341 | 4 570 418 | 211 787 | 176 817 | 99 963 |

| International | Domestic | Regional | Unscheduled | Total | |

|---|---|---|---|---|---|

| Total aircraft landings | 33 156 | 109 075 | 9 354 | 60 202 | 211 787 |

| Variance compared to FY2019/20 | 81% | 82% | 77% | 92% | 84% |

| Total annual departing passengers | 4 268 098 | 11 117 216 | 356 069 | 71 832 | 15 813 215 |

| Variance compared to FY2019/20 | 73% | 77% | 69% | 125% | 76% |

| Total aircraft landings FY2019/20 | 40 707 | 132 324 | 12 134 | 65 726 | 250 891 |

| Total annual departing passengers FY2019/20 | 5 821 311 | 14 527 118 | 517 641 | 57 275 | 20 923 345 |

Passenger traffic

As expected, passenger travel continued to be impacted by COVID-19-related travel restrictions during the first half of the reporting period and by their lingering effect in the second half of the year. Total passenger throughput nevertheless increased by 76% compared to the previous financial year.

Capacity constraints in the domestic market did, however, result in a flat recovery trajectory in that segment. This is slowly being mitigated by the recovery of the route network since the closure of the Comair Group in June 2022. In the regional segment, SAA’s resumption of some regional routes, such as the route between Johannesburg and Windhoek, has been bolstering recovery. Eswatini Air, which has recently launched flights to O.R. Tambo International, is further supporting regional recovery.

The international market segment, on the other hand, has been on a consistent growth trajectory since the IATA Northern Winter 2022 season. New routes and route expansions have been the largest contributors, with Cape Town International Airport being the largest beneficiary. Airlines such as Air Belgium, Condor, United Airlines, Qatar, Emirates and SAA have all contributed immensely to the recovery of the international segment. This has led to a steady upward recovery trajectory, with international recovery for the reporting period finishing at 73%.

ACSA’s three main international airports collectively account for 85% of all air passenger traffic South Africa. O.R. Tambo International accounts for most of this, with 49% of departing traffic, while Cape Town International recorded the highest recovery rate for the period with an overall recovery of 78% in departing passenger numbers. Much of this was due to MICE traffic, with the Western Cape hosting, among others, the Formula E motorsport championship, the Women’s T20 Cricket World Cup, and the International Ice Hockey Federation 2023 Senior Women’s Ice Hockey World Championship. This trend is expected to continue as the region has secured a further 27 bids for major international events and conferences in 2023.

Passenger traffic trends analysis shows the international tourism segment continues to be dominated by traffic from Western Europe and North America, which accounted for 39% of international tourist arrivals pre-pandemic. These two markets accounted for 31.35% of international arrivals during the reporting period. We have therefore identified the African market as a focus for development and ultimately aim to connect South Africa with every major city in Africa. This will significantly diversify the international source portfolio and support Africa’s integration agenda, as expressed in the Abuja Treaty of 1991.

The impact of the continuing war in Ukraine, mainly through its impact on energy prices and consequently on inflation in large source markets like Europe and the USA, nevertheless has the potential to affect our recovery, although the extent to which this will happen is uncertain.

Health accreditation and management

All of the airports in our network are registered on the ACI Airport Health Accreditation Programme. This provides for airports to be regularly assessed in order to ensure that their health measures are aligned with the ACI Airport Operations and COVID-19 Business Recovery Guidelines as well as with the ICAO Council Aviation Recovery Task Force (CART) recommendations and industry best practice.

Throughout the COVID-19 pandemic, our health management practices were also aligned with the ACI Aviation Business Restart and Recovery Guidelines and the ICAO Council Aviation Recovery Task Force recommendations. Our participation in the ACI programme demonstrates to passengers, staff, other airport users, regulators, governments, and the public in general that we prioritise health management in a formal, established, and measurable way.

ACSA is also obligated to comply with the SACAA regulations concerning the management of communicable diseases posing a serious public health risk and has to ensure that appropriate precautionary measures are in place to reduce that risk.

Prior to the COVID-19 pandemic, we had exiting procedures in place to deal with public health emergencies, and these were upweighted in compliance with government-mandated measures to prevent the spread of the COVID-19 virus. Before any of our airports could re-open after the initial ‘hard’ lockdown, our state of readiness had to be approved by SACAA, which conducted thorough inspections to ensure that we were complying with regulatory requirements.

All COVID-19 pandemic-related regulatory requirements were lifted on 22 June 2022 but we remain vigilant to any public health risks that may present themselves and committed to ensuring the safety of passengers and other airport users. As part of this commitment, we continue to develop our digital services in order to minimise the need for physical contact and to improve the overall user experience.

Our COVID-19 pandemic response programme, which was still in place during the first half of the reporting period, is illustrated in the following graphic:

COVID-19 Pandemic Response Programme

Airports Company South Africa's COVID-19 pandemic governance structure

Responsibilities:

- Oversight of the Company's COVID-19 pandemic Response Plan

- Monitor feedback from the aviation industry and align with emerging best practice

- Share learnings with industry and peers

Governance at operational level

Responsibilities:

- Audit of all implementation

- Identify successes and areas of concern

- Identify best practice

- Engage COVID-19 governance structure with findings

Airport operations

Plans in place:

- Passenger capacity and processing

- Flight scheduling

- Employee induction and screening protocol

- Office guidelines

Infrastructure and asset management

Plans in place:

- Cleaning regimes

- HVAC system testing

- Contractor compliance

- Mothballing procedures

People management

Plans in place:

- Provision on PPE

- Staffing plans

- COVID-19 case management employee transport

Client and passenger services

Plans in place:

- Stakeholder engagement

- Staff rosters

Occupational health and safety

In the 2020/21 financial year, we developed and implemented a

new safety management system based on the principles of

ISO

45001. All historic data was collected and migrated to a new

safety management standard, to which all our airports

subscribe.

As well as adhering to strict internal procedures, we manage a large number of infrastructure-related projects, which results in an influx of contractors and service providers. This elevates the risk of injuries within our facilities. We therefore have a stringent contractor management programme, and all of our contractors are screened for compliance with Occupational Health and Safety (OHS) requirements prior to commencing work at any of our airports.

As we also have a large number of stakeholders operating at our airports, it is critical that all of them comply with applicable OHS requirements. We carefully monitored stakeholder operations throughout the COVID-19 pandemic, and this continues in the post-pandemic phase to ensure that compliance is maintained. A total of 141 inspections were conducted during the reporting period in order to maintain compliance at all airports.

In addition, we have on-site OHS clinics at four of our airports: O.R. Tambo International in Johannesburg, Cape Town International, King Shaka International in Durban and Chief David Stuurman International in Gqeberha (formerly Port Elizabeth). These fully equipped clinics had a very important role to play in our frontline response to the COVID-19 pandemic and continue to play an vital role in managing the risk associated with health and safety.

At our other airports, local occupational health service providers are contracted through a nationally appointed service provider to deliver consistent service to all staff and airport users.

Occupational health and safety occurrences

| FY 2022/23 | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Description | FY 2019/20 |

FY 2020/21 |

FY 2021/22 |

FY 2022/23 |

Q1 | Q2 | Q3 | Q4 | |

| Runway incursions | 3 | 1 | 6 | 3 | - | - | - | 3 | |

| Runway excursions | - | - | 1 | 1 | - | - | - | 1 | |

| Runway trespassing events | 2 | - | 5 | 1 | 1 | - | - | - | |

| Total airside trespassing events (including runway trespassing) |

3 | - | 5 | 1 | 1 | - | - | - | |

| Airside aircraft-related incidents/ accidents |

29 | 3 | 13 | 18 | 5 | 3 | 6 | 4 | |

| Bird strikes | 305 | 172 | 195 | 254 | 52 | 39 | 82 | 81 | |

| Non-work fatalities | 31 | 13 | - | 24 | 1 | 6 | 5 | 12 | |

| Work fatalities | - | - | - | 1 | - | - | - | 1 | |

| COVID-19 fatalities | - | 4 | 20 | - | - | - | - | - | |

| COVID-19 infections | - | 458 | 463 | 28 | 25 | 1 | 1 | 1 | |

| Work-related severe injuries | 81 | 6 | 6 | 16 | 3 | 2 | - | 11 | |

| Medical treatment case (including work and non-work related |

322 | - | 21 | 745 | 50 | 168 | 217 | 310 | |

| Occupational diseases | - | - | - | 2 | - | - | - | 2 | |

| Noise complaints | 11 | 3 | 5 | 5 | 1 | 1 | - | 3 | |

| Significant spillages | - | - | - | - | - | - | - | - | |

| Non-conformances reported | - | - | 1 | 1 | 1 | - | - | - | |

| FY2021/22 | FY2020/21 | FY2019/20 | |

|---|---|---|---|

| Property damage incidents | - | 5 | 3 |

| Non work-related fatalities, including COVID-19 fatalities | 20 | 13 | 31 |

| Work-related fatalities, including COVID-19 fatalities | - | 4 | - |

| Disabling and/or severe injuries resulting in lost time, including COVID-19 hospitalisations |

6 | - | |

| Non-disabling injuries requiring medical treatment, including COVID-19-related quarantine |

484 | 458 | 87 |

| Non-disabling injuries requiring First Aid, including near misses | - | 4 | 392 |

| Occupational diseases | - | - | - |

| Total | 510 | 490 | 514 |

Security

We have adopted an integrated, multi-agency safety and security approach throughout our environment to enhance airport and aviation security in general. During the reporting period, we rolled out an aviation security model that is vertically and horizontally integrated with other law enforcement authorities. This initially focused on passenger security and was later broadened to include cargo and infrastructure security, relying on internal capacity rather than outsourced security arrangements.

An insourcing framework for screening services at central security points was finalised and this is now in the implementation phase. By using this insourcing framework, we aim to create permanent jobs and sustainable livelihoods for those entrusted with securing our airports

New security screening technology is also in the process of being procured and will create efficiencies that benefit the organisation as a whole. The technological enhancements these provide will ease passenger facilitation, strengthen confidence in our services and enhance the overall customer experience.

| Security operations | Actual | Target | ||

|---|---|---|---|---|

| FY 2021/22 |

FY 2022/23 |

FY 2022/23 |

||

| Prevent acts of unlawful interference | 0 | 0 | Zero acts of unlawful interference | |

| Preventing acts of unlawful interference | Protect baggage and reducing pilferage | 12% | 33% | A 10% reduction in baggage pilfering incidents year-on-year |

| Screen of all passengers and baggage | 100% | 100% | 100% screening of passengers and baggage | |

| Crime management | Reduce criminal activities, especially major incidents | 1 | 1 | 1 major incident (heist, (stowaway/s, armed robbery, or attack) |

| Security Compliance | Reduce repeat findings by internal audit | 3 | 13 | Zero repeat findings |

| Reduce SACAA Level 1 findings | 172 | 195 | Maximum 20 SACAA Level 1 findings | |

Aeronautical revenue

Aeronautical revenue, which is derived from regulated tariffs for

aircraft movements and related services, improved by 64% to

R3 billion during the reporting period (FY2021/22: R1.8 billion).

This was due to increases in the number of aircraft landings and

departing passengers as well as the 3.1% tariff increase for the

year. Aircraft landings improved by 20% to 211 787

(FY2021/22:

176 817 and departing passenger numbers improved by 50% to

15 813 215 (FY2021/22: 10 538 202).

Non-aeronautical revenue

Our non-aeronautical revenue is generated from two businesses: The core commercial portfolio and the non-core commercial portfolio.

The core commercial portfolio includes seven businesses: advertising, retail, car parking, car rental, property rental, hotel operations and airports management services. The non-core commercial portfolio includes training, consultancy, and the advisory services business. In addition to contributing to revenue, these businesses provide many opportunities to further our broader transformation agenda by supporting black businesses and creating jobs.

The full non-aeronautical portfolio saw a significant improvement during the reporting period, with revenue increasing by 46% to R3.1 billion (FY2021/22: R2.1 billion) and reflecting a significant improvement in trading conditions during the year. The bulk of this income was derived from property rentals (R982 million) and retail activities (R848 million).

While our commercial operations are on the road to recovery, we anticipate that it will take some time for revenue to return to pre-pandemic levels, especially as there has been a realignment of the air travel market and changes in consumer behaviour over the past three years.

Outlook

With the COVID-19 pandemicrelated State of Disaster having been lifted on 22 June 2022, we have been able to begin the long journey towards full recovery and, ultimately, towards growth and development.

During the current period and going forward, we will remain focused on our core business of running airports and will continue to strive for continuous improvement in the passenger experience. We will simultaneously focus on extending and developing our cargo handling capabilities and the services we offer to our customers in the cargo and logistics industries.

More ambitiously, we are aiming to redefine the place of the airport in city life and to make airport hubs more attractive leisure destinations for both passengers and the public in general. We intend to do this by diversifying our range of services and by working towards creating an integrated and interconnected aerotropolis at each of our airports. We will continue to do this in cooperation with our shareholder, our business partners and all of our stakeholders.

© Copyright 2023 ACSA