CFO’S REPORT

Throughout the previous two reporting periods, we showed remarkable agility and resilience in overcoming a multitude of external challenges, paving the way for ACSA to achieve a firm post-pandemic recovery position. This demonstrates the Group’s commitment to adapting and thriving in a rapidly changing environment.

Ms. Lindani Mukhudwani Acting Chief Financial Officer

REVENUE

55%

55%

R6 billion

(FY2021/22: R3.9 billion)

EBITDA

497%

497%

R2 billion

(FY2021/22: R342 million)

CAPITAL EXPENDITURE

23%

23%

R2 billion

(FY2021/22: R546 million)

TOTAL ASSETS

5%

5%

R2 billion

(FY2021/22: R30.1 billion)

LOSS FOR THE

YEAR

86%

86%

R143 million

(FY2021/22: R1.0 billion)

INVESTMENT PROPERTY

BALANCE

3%

3%

R7.7 billion

(FY2021/22: R7.9 billion)

CONCESSION

INVESTMENTS

6%

6%

R187 million

(FY2021/22: R199 million)

GEARING

RATIO

11%

11%

24%

(FY2021/22: 26%)

OPERATIONAL

EXPENDITURE

6%

6%

R3.5 billion

(FY2021/22: R3.3 billion)

AIRCRAFT

LANDINGS

20%

20%

211 787

(FY2021/22: 176 817)

DEPARTING

PASSENGERS

50%

50%

15 815 213

(FY2021/22: 10 538 341)

In the 2022/23 financial year, ACSA achieved a notable improvement in earnings before interest, tax, depreciation, and amortisation (EBITDA), reaching R2.0 billion (compared to R342 million in the 2021/22 financial year). This growth can be attributed to the gradual recovery of air traffic movements and passenger numbers globally, including in South Africa, as COVID-19 pandemic related travel restrictions were progressively lifted in all major air travel markets.

While we observed an uneven recovery across the different market segments we serve throughout the year, our Recover and Sustain Strategy and our revised Financial Plan, adopted in the middle of FY2020/21, provided us with the framework to achieve a 55% increase in revenue, amounting to R6.0 billion for the period (FY2021/22: R3.9 billion). Our efforts to closely manage operating expenditure, which amounted to R3.5 billion (FY2021/22: R3.3 billion), also contributed to the reduction of our loss to R143 million, a significant improvement from the previous year’s loss of R1 billion. Profitability was nevertheless impacted by high credit losses on trade receivables and fair value loss on investment properties.

The improvements in our financial performance are testament to our unwavering dedication and relentless pursuit of sustainable development and growth in our business. The entire team across all divisions has diligently worked towards optimising our operations, continuously streamlining our value creation and delivery processes. This has successfully secured a strong footing for our business in the post-pandemic landscape. We remain committed to our long-term goals and will continue to adapt and thrive amid evolving market demand and supply conditions.

We had to contend with significant levels of uncertainty during the year driven by the after-effects of the pandemic, sluggish global economic growth, inflation, and the unfolding geopolitical situation caused by the war between Russia and Ukraine.

Both local and global uncertainties made it challenging to accurately predict demand for air travel and other revenue streams as these events increased the complexity of our business planning and funding processes.

The Recover and Sustain Strategy and the revised Financial Plan nevertheless provided us with a structured management approach and a means of resourcing the business in a way that has enabled us to secure and safeguard the Group’s long-term sustainability.

Revenue

Aeronautical revenue improved significantly by 64% to R3 billion (FY2021/22: R1.8 billion). This was due to a 20% increase in aircraft movements to 211 787 (FY2021/22: 176 817) and a 50% increase in the number of departing passengers to 15.8 million (FY2021/22: 10.5 million). The implementation of the 3.1% tariff increase approved by the Regulating Committee also contributed to the increase in revenue.

Non-aeronautical revenue followed a similar trend, increasing by 46% to R3.1 billion (FY2021/22: R2.1 billion) and reflecting a significant improvement in trading conditions during the year. The bulk of this income was derived from property rentals (R982 million) and retail activities (R848 million).

Operating expenditure

Other operating expenditure increased by 10% to R2.2 billion (FY2021/22: R2 billion). This was largely due to increases in the cost of maintenance and information systems, reflecting the full reopening of airports and supporting services. Utilities costs, in particular, increased due to higher consumption and higher energy prices.

Property, plant, and equipment

Capital expenditure for the year amounted to R422 million (FY2021/22: R546 million). This was limited to airport maintenance and resilience, with most uncontracted projects remaining on hold until funding is available.

The value of property, plant and equipment decreased to R16.5 billion (FY2021/22: R17.5 billion), primarily due to wear and tear as well as the minimal expenditure on improvements and additions during the year.

Investment properties

The value of investment properties decreased to R7.7 billion (FY2021/22: R7.9 billion) as at 31 March 2023 due to a fair value loss of R209 million (FY2021/22: R91 million), which was offset by R9 million in additions and transfers from the property, plant, and equipment category.

The decline in the fair value of investment properties reflects the slow recovery of the commercial property market in the aftermath of the pandemic and the difficult trading conditions prevalent during the financial year.

Trade and other receivables

Trade and other receivables closed with a balance of R1.7 billion (FY2021/22: R1.7 billion). Although higher revenues were recorded, we wrote off R463 million (FY2021/22: R197 million) in irrecoverable debts. We did, however, improve debtors’ collections, with cash from operations collected during the financial year amounting to R6.4 billion (FY2021/22: R4.0 billion). The debt book value determination is based on the probability of collection, which reflects prevailing economic realities.

Funding

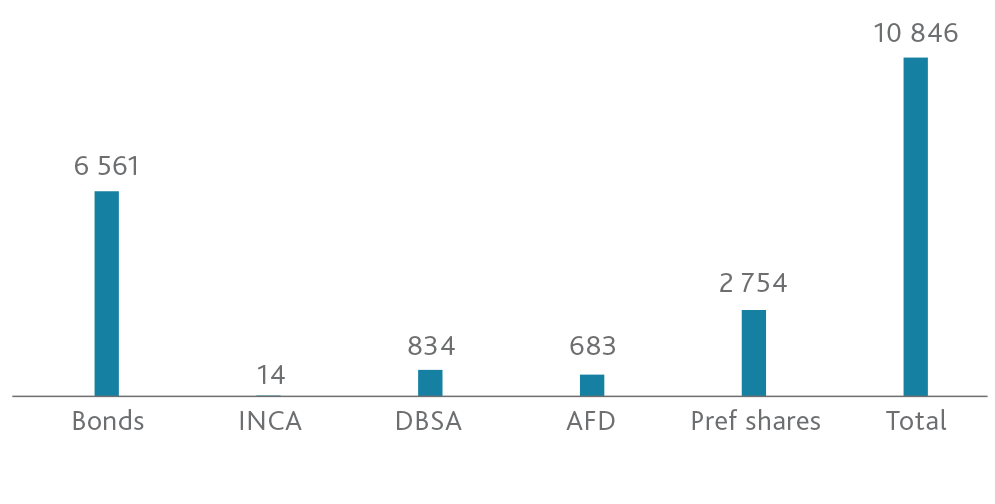

Cash and cash equivalents, including short-term investments, closed with a balance of R4.9 billion on 31 March 2023 (FY2021/22: R2.2 billion). The increase of R2.7 billion over the previous period was largely due to cash of R2.2 billion being generated from operations and the inflow of R264 million in interest income. Liquidity was further supported by a successful R1.7 billion bond issue in the third quarter of the year.

Further, our gearing ratio for the 2022/23 financial year was 24%, down from 26% in the previous period and well below the debt covenant limit of 65%. The year-on-year improvement in this ratio was partly due to the fact that we repaid R296 million in debt comprised of amortising loans during the reporting period. Interest payments over the same period amounted to R617 million, resulting in debt servicing costs being R913 million.

The AIR02 fixed-rate bond (R1.7 billion) matured on Sunday, 30 April 2023 and was repaid on 2 May 2023 in line with the following business day convention. The payment was made from the funds raised through the bond issuance proceeds between November and December 2022.

The Group is expected to maintain a positive cash position over the next 12 months and to end the period with a cash balance of R3.2 billion. New debt funding will not be required over the forecast period.

INTEREST BEARING BORROWINGS

(Rmillion)

Credit metrics

All loan covenant ratios, including the Net Debt-to-EBITDA Ratio and the Debt Service Coverage Ratio, for which AFD granted ACSA an extension of the waiver period to March 2024 on historical and projected breaches, fell within the required thresholds for the first time in three financial years. The projection for the forecast period is as follows:

| Covenant | Requirement | FY2022/23 (Actual) |

FY2023/24 (Projected) |

|---|---|---|---|

| Credit Ratings Requirement | Above investment grade BBB (national scale) | Aa2.za | Aa2.za* |

| Net Debt Capitalisation | Shall not exceed 65% | 24% | 27% |

| Net debt/EBITDA | Shall not exceed 4 times | 2.9X | 3.3X |

| Government Shareholding | At least 50% plus one share | 74.6% | 74.6%* |

| Debt Service Cover Ratio by Available Cash | Not less than 1.5 times | 8.1X | 2.0x |

Credit rating

The Group’s rating outlook remains negative which, according to Moody’s, reflects significant uncertainties around air traffic recovery prospects and the determination of regulatory tariffs.

| Ratings | ||||

|---|---|---|---|---|

| Agency | Rating action | Long term local currency | Long-term national scale | Outlook |

| Moody’s | Affirmed | Ba2 | Aa2.za | Negative |

Irregular expenditure

Irregular expenditure of R59.1 million was incurred in the current financial year (FY2021/22: R36.7 million). The Group has implemented National Treasury’s Irregular Expenditure Framework through its loss control function for detection, assessment, investigation, and performance of determination tests. As a result, the Board of Directors removed cumulative expenditure of R130 million relating to previous years, and R124 million was de-recognised. This brought the cumulative balance to R285 million as at 31 March 2023 (FY2021/22: R442 million).

ACSA complies with the National Treasury Irregular Expenditure Framework as updated from time to time. Compliance is monitored through the Group’s loss control function, which performs detections, assessments, determinations, and investigations of expenditure transactions.

Full reconciliations of the cumulative irregular fruitless and wasteful expenditure balances from 31 March 2022 to 31 March 2023 can be found on page 133 of this report, in line with National Treasury’s reporting guidelines for irregular, fruitless and wasteful expenditure.

Outlook

Profitability is expected to improve during the two-year period from FY2023/24 to FY2025/26, as outlined in the current Corporate Plan. This improvement is expected due to a moderate traffic volume growth forecast of 16.7 million departing passengers, up from a 15.8 million in the reporting period.

The Regulating Committee granted the Company an interim tariff increase equivalent to CPI of 4.4% at the end of January 2023. The tariffs were effected from 1 May 2023 to allow for the three months’ notice required by the Airports Act.

The capital expenditure programme provides for investments of approximately R3.6 billion over the next three years. Up to 70% of this spend has been allocated for refurbishments and replacement projects.

The Group continues to monitor the business environment to determine appropriate responses and to ensure long-term financial sustainability. It also continues to identify efficiencies in its operations, keeping operating expenditure to a minimum.

Ms Lindani Mukhudwani

Acting Chief Financial Officer